Overview of global pork market developments in 2020

World total pig meat trade reached 11.9 million tonnes in 2020, up 24.5% year-on-year, helped by Chinese imports, which almost doubled to 5.7 million tonnes, accounting for around 50% of global imports. Because of the large volume requirements, China issued export licenses to many processing plants in several countries, including Brazil, Chile and Mexico. Viet Nam too registered a sharp increase in imports, again reflecting ASF-related output downturns. By contrast, the Republic of Korea and Japan purchased less because of reduced restaurant sales and high retail prices.

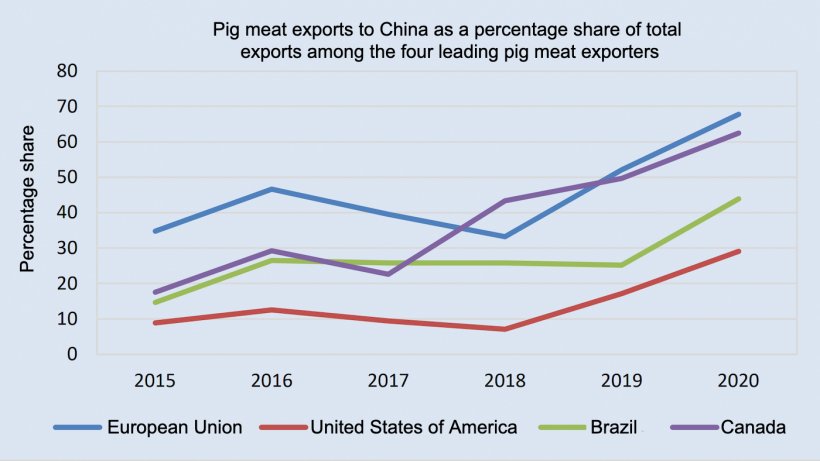

Concerning exports, much of the expanded exports originated from the European Union, the United States of America, Canada and Brazil, as extensive initial pig inventories and reduced internal sales bolstered export availabilities. The USA exported 900 000 tonnes to China, equivalent to around 30% of total exports, while Brazil’s shipments rose by 34% to 1.3 million tonnes, with nearly two-thirds shipped to China. High imports by China were behind much of the growth in exports from Mexico and Chile too. Despite ASF-related export restrictions to Asian markets, the European Union concluded the year with a 27% growth in exports. In Canada, high inventories and government support under the emergency assistance programme underpinned the export expansion. The Russian Federation increased exports by 101%, emerging as a significant global player, with most shipments moving to Viet Nam under the market access agreement signed in 2019.

Global pig meat output in 2020 is estimated at 109.2 million tonnes, down 0.8% from 2019, principally due to ASF-induced production contractions in China, the Philippines and Viet Nam. However, the United States of America, Brazil, the European Union, the Russian Federation, Canada, Mexico, and Chile registered moderate production expansions, partially offsetting production contractions elsewhere. Following a 21% fall in 2019, China’s pig meat production declined by only 3.3% in 2020 to 42 million tonnes, indicating a faster recovery of pig inventories from the viral disease, reaching nearly 76% of the level that existed before ASF-led declines began in 2018. Pig meat production also suffered setbacks in the Philippines and Viet Nam, as ASF-induced culling pigs continued in some farms.

Elsewhere, pig meat production increased in the United States of America, Brazil, the Russian Federation, the European Union, and Canada. In the USA, output rose, driven by high pig inventories, but the growth rate weakened due to labour constraints and reduced plant capacity utilisation. Brazil continued to expand output as import demand remained strong, while government financial support to households stabilised domestic demand. In Russia, output expansion was mainly due to the high output delivered by large-scale farms and vibrant demand from East Asia. In the European Union, production expansion continued, underpinned by significant output advancements in some member countries, especially Spain and Denmark, principally driven by ASF-free status and access to Asian markets. In Canada, increased slaughtering and carcass weight contributed to the output expansion.

The average annual pig meat prices fell from USD 2 290 in 2019 to USD 2 209 per tonne in 2020, a decline of 3.6%.

24 March 2021 ,from pig333.com Professional Pig Communitiy.

Global pig meat output in 2020 is estimated at 109.2 million tonnes, down 0.8% from 2019, principally due to ASF-induced production contractions in China, the Philippines and Viet Nam. However, the United States of America, Brazil, the European Union, the Russian Federation, Canada, Mexico, and Chile registered moderate production expansions, partially offsetting production contractions elsewhere. Following a 21% fall in 2019, China’s pig meat production declined by only 3.3% in 2020 to 42 million tonnes, indicating a faster recovery of pig inventories from the viral disease, reaching nearly 76% of the level that existed before ASF-led declines began in 2018. Pig meat production also suffered setbacks in the Philippines and Viet Nam, as ASF-induced culling pigs continued in some farms.

Elsewhere, pig meat production increased in the United States of America, Brazil, the Russian Federation, the European Union, and Canada. In the USA, output rose, driven by high pig inventories, but the growth rate weakened due to labour constraints and reduced plant capacity utilisation. Brazil continued to expand output as import demand remained strong, while government financial support to households stabilised domestic demand. In Russia, output expansion was mainly due to the high output delivered by large-scale farms and vibrant demand from East Asia. In the European Union, production expansion continued, underpinned by significant output advancements in some member countries, especially Spain and Denmark, principally driven by ASF-free status and access to Asian markets. In Canada, increased slaughtering and carcass weight contributed to the output expansion.

The average annual pig meat prices fell from USD 2 290 in 2019 to USD 2 209 per tonne in 2020, a decline of 3.6%.

24 March 2021 ,from pig333.com Professional Pig Communitiy.